by Lee Dussinger

Jake from State Farm, Limu Emu & Doug, Flo, Martin (the Geico Gecko) – some of the most distinct characters – and brands – to grace public consciousness come from insurance marketing. Chances are nearly 100% that you can put a face to a name (and possibly a catch phrase or jingle) for all of these. However, those colorful characters only represent one sector of insurance brands…

Health, property, home, life, business, and countless other types of coverage fall under the 10-billion-dollar-per-year umbrella of insurance advertising. International auto insurance brands, health insurance companies, and everything in between needs to bring their message to market in a way that resonates with their audience.

Opal’s marketing platform is used by a spectrum of leading insurance brands like State Farm, United Healthcare, and Allianz. Because of that, we have a front row seat to how prominent insurance brands go to market, as well as the challenges they face.

We’re spotlighting the challenges of insurance marketing, exploring strategy, and highlighting why the Opal platform is the choice for several leading insurance brands.

5 Challenges All Insurance Brands Face in 2023

The idea is the same: insurance marketers need to create brand content that connects with their audience. Whether that content looks like a wellness white paper, or a colorful commercial character, depends on the brand – and often – the type of insurance.

While the messaging and the presentation will differ drastically, the difficulties within insurance marketing tend to be fairly similar. While you’re more likely to see a health insurance giant create wellness content rather than auto insurance commercials with an British lizard, the processes that lead to those outcomes are fairly similar.

These are the 5 most common challenges that insurance marketers must deal with and overcome:

Competition in the Market – This one holds true particularly in the auto and home insurance spaces. Think back to the whole litany of brands and characters we rattled off…that represents a metric ton of competition! When marketing an insurance brand, you are going up against other well-established and beloved brands. In order to make an impact, your messaging and your placements need to be perfect. Otherwise, you risk being swept aside in a tidal wave of quotable, big-budget marketing campaigns!

No Physical Product or Space – One of the major challenges with insurance marketing is that the brand isn’t backed by a physical object or location. You’re exclusively asking your audience to identify with the perceived value of your service and what your brand represents. Joe Curry, Director of Brand Marketing at United Healthcare, said it best at the Opal Brand Futures Summit: “We don’t have a lot of touchpoints. We’re not a consumer brand, there’s not a physical space you can go into,” he explained. “Most likely the only thing you may have is a member ID card.” Ultimately, this is primarily a marketing challenge to solve because you don’t have a product to advertise – all you have is a brand story to tell.

Audience Interest – While selecting the correct insurance provider is crucial, it’s not something most consumers are eager to do. “People spend more time shopping for cars than they do for their own health insurance,” Joe Curry says. “When you think about the cost implications of how much money you invest in health insurance a year, people would do better to spend a little more time to select their plan.” Good marketing can solve this by providing resources or creating compelling messaging to overcome potential apathy!

Regulations – This could be a full blog topic in and of itself. Marketing for both health and property insurance are more heavily regulated than many other industries. Governed by both individual state and federal laws, regulations around insurance dictate what you can say and what you can offer. The marketing challenge of insurance here is that creating a robust brand and content strategy requires navigating complex legal requirements. Working through this volume of requirements slows down the marketing cadence – and missing something can have potentially serious consequences.

Consistency and Alignment – Maintaining brand alignment is a challenge for many brands – regardless of the industry. When marketing for insurance brands, these difficulties can be compounded. Larger insurance groups often have separate arms or divisions that go to market differently – while remaining under the same big umbrella. This can make organizing those vastly different messages and motions a serious logistical challenge for brand managers.

Why Insurance Brands Plan, Create & Calendar in Opal

Whether the brand you represent is a mid-sized insurance provider or one of the international standouts we mentioned in the opening, you likely recognize many of these challenges of insurance marketing. While those difficulties are features of the field, the right tech can minimize their impact.

Here’s how the Opal software platform helps our insurance customers:

Robust Feedback, Reviews & Approvals – Careful content reviews are the best method to ensure your brand complies with the regulations around insurance marketing. The Opal platform has numerous features to facilitate this. Powerful automated workflows ensure that content never makes it to market without going through the necessary review process. On top of that, in-content reviews enable you to leave actionable feedback directly on the text or image that needs to be updated. The more important content reviews are, the more necessary a purpose-built solution becomes.

See Everything on a Visual Calendar – Multiple company divisions, across several channels, with countless messages…all speaking to your audience at once. Seeing EVERYTHING at the same time on a central, visual calendar is the solution. Now, you can understand exactly how your brand is showing up at any given time in just a second. Plus, if you need to make on-the-fly changes, you can reschedule campaigns right from the calendar.

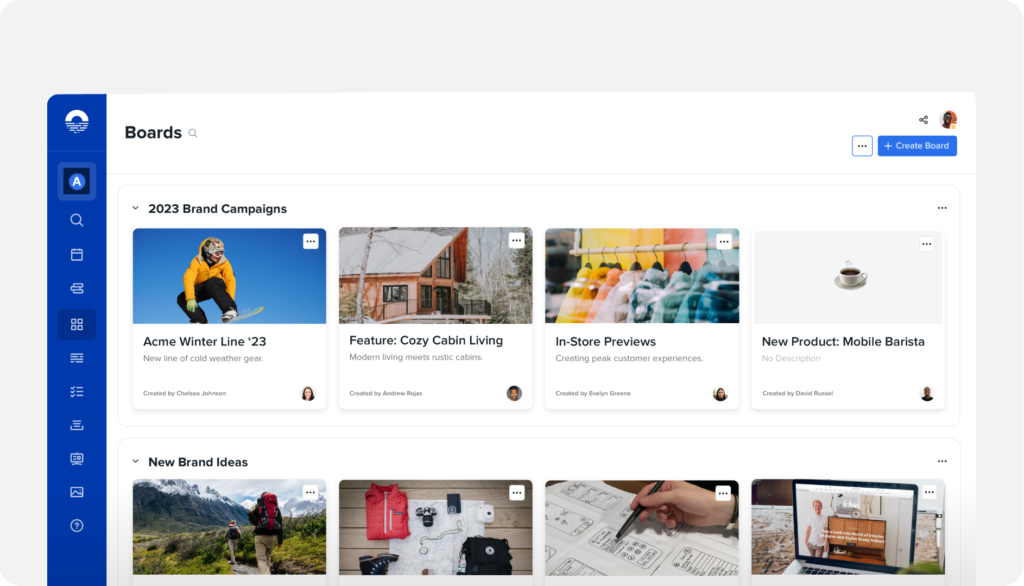

Better Brainstorming for Better Ideas – There’s no question that marketing for insurance is one of the most competitive spaces. Great ideas and great content are the only solution to stand out in a sea of exceptional brands. That’s why Opal’s collaborative brainstorming features are popular for teams trying to find and iterate on the very best ideas. Think about using Opal like your virtual whiteboard – to ensure that your team can capture and share their best creative sparks!

Explore the Opal Platform

Opal is a marketing platform specifically designed for brand content. From social posts to international commercial spots – it all starts here. The ability to unlock your best brainstorming, perform necessary reviews, and see your brand in-market takes your work to the next level.

To witness firsthand how the Opal platform can revolutionize your insurance marketing planning, creating, and calendaring, there are two avenues you can explore.

Firstly, you can request a personalized demo from one of our product specialists. They will guide you through the platform’s extensive capabilities, providing an immersive glimpse into how Opal can transform how your team works.

Alternatively, if you prefer a hands-on learning experience, our free 14-day trial is the correct choice for you. Gain full access to the entire range of Opal’s features, so you can start planning, creating, and calendaring your insurance brand.